TAF’s annual conference and best practice exchange offers unrivalled networking and insights for 250 key professionals in the UK

trade association sector. Meet dozens of other trade association colleagues, network with key suppliers at the exhibition throughout

the day, and stay on for a sociable drink and chat afterwards!

Our programme kicks off at 09.30 and covers all aspects of trade association leadership and operations; morning highlights include

keynote speaker Martin McTague, National Chair of the Federation of Small Businesses (FSB) – who will address challenges and opportunities for growth; and Verity Davidge, Director of Policy at MakeUK who will discuss regional growth and industrial strategy. Later, Climate Action for Associations (CAFA)’s CEO Alison Heppenstall will talk us through leading our sectors’ journeys to net zero, with CBI’s Jennifer Beckwith.

Take a look at all of our fantastic speakers on our speakers page, and to see which panel they’ll be speaking on, head to the programme here.

BPEX24 takes place at the BMA in London on Thursday 5 September. TAF member tickets are 1 for £180, or 3 for £360. Non-member tickets start at £210.

Tickets can be purchased here

Contact Secretariat@taforum.org for more information

Post-pandemic, the shift towards remote and hybrid working has become a defining feature of the modern workplace, with trade associations leading the charge. The 2023 Trade Association Forum (TAF) benchmarking survey highlights diverse approaches:

- 97% of responding trade associations permit some degree of home working.

- 28% of respondents allow staff full choice over where they work, 37% mandate a certain number of office days, and 14% specify which days must be in the office.

- Almost one in five trade associations who responded have no fixed office, up from 9% the previous year, with 83% of these being small associations with fewer than six employees.

Embracing a flexible workforce offers significant benefits, including improved recruitment, retention, accommodating a diverse workforce, and cost savings from cutting back on office expenses. But in a recent webinar I led with TAF members on building great trade association teams, there were more questions about how to build strong hybrid teams than on anything else.

Because there are clearly challenges to hybrid and remote working too. Do these questions sound familiar?

- How do we support new joiners to embed into our team?

- How can people learn if they are not together?

- Do we trust that work is being done?

- How do we know that the team is productive?

- How do we foster collaboration?

- Are team members lonely? Am I lonely?

- Does our tech support our approach?

- How will we know if our approach is working?

TAF members are not alone in grappling with this issue. We’re in a strange period of transition, where organisations often face competing expectations from leaders, managers, employees, members and customers.

We’ve all seen the high-profile big beasts of finance and banking (now increasingly followed by corporates and even tech companies) demanding their teams return to the office four or five days a week. The ‘right’ to flexibility at work is becoming increasingly political.

So how do trade associations navigate these challenging times? Here are five ideas to guide your thinking:

1. Take stock, be deliberate, then embrace flexibility

Many teams made radical changes to working practices during Covid. They jumped quickly, out of necessity – often without fully revisiting the decisions taken again. Now it is time to take stock and understand how and where teams are working together now. Taking time for a deeper review of where you have ended up could be the most important decision you make this year. Then set a timeframe to review again as the external landscape continues to evolve.

2. Prioritise principles over rules

While some organisations impose strict return-to-office mandates, trade associations have the agility to adopt more flexible approaches. Instead of rigid rules, develop agreed principles across the organisation, providing direction, consistency and inspiration. This can be a fulfilling exercise for the whole organisation, allowing everyone to explore and agree on ‘what matters here’. There is growing consensus that specific working arrangements are best decided at team level – so encourage individual teams to use the shared principles to form their own working arrangements.

3. Make in-person meetings matter

While remote work offers flexibility, in-person interactions are invaluable for building strong team relationships and enhancing collaboration. Organise regular, intentional in-person meetings focused on strategy, collaboration, and social interaction. Ensure that these gatherings are meaningful and productive, rather than just a series of video calls conducted in the same physical space. Be creative about how your physical workspace can enhance performance and joy. Whether it’s a regular office or a shared working space, ensure it supports your team’s needs and fosters a positive working environment.

4. Invest in managers

Managing in a hybrid world is increasingly challenging. Expectations are growing, but training isn’t keeping pace: recent research by the Chartered Management Institute found that 82% of new managers have no training. How well are your managers equipped to provide the level of support needed by team members who aren’t together in the same space?

5. Don’t stop talking

Communication is the cornerstone of effective hybrid teams. In a hybrid setup, regular and open communication helps ensure everyone feels connected and valued, regardless of their location. Encourage people not to become over-reliant on messaging tools; help them to have voice or video calls. Model behaviour that allows deeper communications rather than wholly functional or operational – if the classic ‘watercooler moment’ no longer exists, this is part of the way you will need to build connection.

Building great hybrid teams requires a combination of flexibility, open communication, and a positive mindset.

Every trade association will find its own path, but sharing experiences and ideas can help. Join our upcoming Leaders Lunch on July 18 in London to discuss how workplace trends are impacting trade associations.

Caroline Gordon

Founder

Mix Partners

*Want to know more about what makes a successful trade association team?

Join Caroline for a leaders lunch on Thursday 18th July, discussing ‘Building strong trade association teams in a changing world of work’

Final spaces remaining, RSVP here

We know there is going to be a General Election in the next nine months, we just don’t know when. It certainly won’t be 2 May. Did Jeremy Hunt hint at October? Or would the Prime Minister prefer mid-November? Whatever happens, it must be before 28 January 2025.

With the Election moving ever closer, there is speculation over what might be in the parties’ manifestos. Their degree of preparedness varies widely:

· The Conservatives’ manifesto usually emerges close to the election campaign itself through a “behind closed doors” process. Not surprisingly, the published policies on the party website focus on the current government.

· The process for drawing up the Labour Party manifesto is laid down in the party rulebook, based on National Policy Forum position papers approved by its Conference. Apparently, the manifesto policies were locked down in February in readiness for an early Election.

· The Liberal Democrats have published a pre-manifesto paper, which will be approved by conference.

· The Green Party manifesto will reflect its political programme set out on its website.

· The Scottish National Party and Plaid Cymru both have detailed policy positions drawn from their 2021 national election manifestos.

· Reform UK has published “Our contract with you” as a working draft for comments, challenges and queries, which they will finalise later in the year.

Many trade associations will be thinking about producing a manifesto in some form for the Election. Some are already well ahead of the game, and it’s worth looking at these to highlight best practice and illustrate what to think about if you are considering putting together a manifesto for your own association.

What is your objective?

Even if your intention is simply to re-package your existing policy positions, don’t neglect the opportunity to set out your positive vision for your sector. This should link to your association’s overall strategy. While the focus may be on the Election, take the opportunity to think beyond it to set out your agenda for the whole Parliament. The British Retail Consortium’s manifesto Accelerating Investment in the Everywhere Economy does just this, breaking each policy area down into three elements:

· Context and background, with some key facts and statistics

· Policy Briefing – Where are we now? Where do we want to get to?

· How do we get there?

It also includes a brilliant infographic as a clear, succinct summary of the main policy proposals. Elsewhere, the pledge-card style five-point summary is well-established and widely used. Logistics UK takes it one step further, adding an action plan for the first 100 days of a new government.

Stronger with evidence and data

Take the chance to highlight the wider impact of what you are proposing to the economy and community as much as the benefits to your sector. If you can, include an estimate of whether your

policies would be fiscally neutral for the new government, or even revenue-positive. If your proposals are going to cost the Government money, show how much and how the policy benefits achieved will outweigh the cost. Women’s Aid’s manifesto A Whole System Response to Domestic Abuse cites extensive research, much of it produced by its in-house team or working with external partners, to back up the case for its policy proposals. The Agricultural Industries Confederation manifesto includes a call for “a comprehensive, cohesive UK Government approach to food security and land use”, with a QR code linking to an independent report, “Powering Productivity for Sustainable Food Security” by Dr Marcus Bellett-Travers of Anglia Ruskin University

Reflect the political context

Where possible, you should try to reflect the language of the current debate. It can be difficult to judge what that might be at this stage, but it is important to have an eye to it. However, as the terms of the debate become clearer, certain phrases will be seen as targeted to one party or another, and so risk a reaction from opponents.

Think about how to use it

The manifesto should become the basis of your engagement with political parties over the next year and beyond, so it is worth giving some thought as to how best to use and communicate it. It makes sense to think about multiple formats, adapting to the range of channels now available. You should make sure that at least one of these is a format which is easy for members to use when they engage with local candidates. The Royal Pharmaceutical Society’s manifesto includes a pledge form to encourage members to ask candidates to sign and post online to show support.

Remember the things others don’t think about

It’s easy to get tunnel vision when setting out your own best case. Nevertheless, it is worth bearing in mind what others will be calling for in relation to the issues you are raising. You probably know who your allies are and how you might be able to strengthen your call by aligning with them. Do you know the counter-arguments to what you want? How do you address them? Can you explain why your policy positions are preferable? A government that adopts your policies will expect you to be able to support them against any opposition, so you should ensure you are prepared.

Richard Lambert

Senior consultant

Pragmatix Advisory Limited

A collaboration between TAF, FSB and CBI has published a 2024 list of inspirational women in trade associations to coincide with International Women’s Day

The list was compiled from over 200 nominations from the sector and the selection panel had the unenviable task of selecting the 100 women that make up the 2024 powerlist.

Nicola Bates, Chair of the Selection Panel and CEO of WineGB said:

“In this second year of judging we continue to be impressed by the achievements of the top 100 UK women in the powerlist. It is also right that we have extend the recognition with a new category promoting the work of volunteers; given that they are often leading their business and their sector at the same time the respect is enormous as without their work trade associations wouldn’t have the impact they do in supporting UK Plc. It is tremendous that we pause and reflect on their impact – congratulations to all on the list. We should also acknowledge the hard work of the wider nomination pool who while not on the list made the choice incredibly difficult given your extent of work.”

CBI Chief Executive Rain Newton-Smith said:

“I am delighted to bring the CBI, FSB and TAF together to champion the role of women in trade associations, celebrate their achievements and encourage the next generation of women into the association sector.”

FSB Chief Executive Julie Lilley said:

“This powerlist is a testament to the women who make a real difference to trade associations and the industries they represent. Honouring them on International Women’s Day (IWD) is an important way to pave the way for the next generation of female leaders.”

Julia Garvey, Vice Chair of TAF said:

“It was an honour to judge this year’s WITA list and to discover more about the outstanding women leaders within our industry. I hope this list shines a light on their achievements and provides the next generation with the inspiration and aspiration to follow in their footsteps.”

Helping your association navigate the education and skills landscape

A skilled workforce is at the heart of every successful association and business, and attracting and developing the right workforce can be a challenge.

Getting involved with the education and skills system can be part of the solution, even for small associations. Recruitment for example, becomes streamlined because you’ve engaged early with the next generation of talent. And your existing workforce can gain from flexible upskilling or reskilling options revealing new opportunities for your association to grow.

That said, we know that education and skills in England has changed and can be complex to understand, which is where Education Landscape: A guide for Employers comes in.

Did you know:

- Small and medium sized businesses make up 99% of registered businesses in the UK

- TAFs 2023 benchmarking survey recorded 47% of associations as being either small or very small associations

- 4 out of 5 small and medium sized businesses have recruitment concerns, and more than half fear there is a lack of candidates with the right knowledge and skills

A national commitment to small associations and small businesses

We’re committed to helping trade associations find the education and skills landscape easier to navigate. That’s why we’re sharing Education landscape: A Guide for Employers, which has been developed in partnership with organisations including the Federation of Small Businesses, CBI, British Chamber of Commerce, and IoD to help associations across England. The Guide includes a clear, short overview of the education and landscape system, and concise information about the education and skills opportunities that associations and businesses can engage with, and the benefits these offer. There are links to further information for the options you want to prioritise.

The Education Landscape has already proven successful with TAF Member: the Electrical Contractors’ Association, who share their experience below:

Case Study: Electrical Contractors’ Association and the Education Landscape

“Education Landscape approached me at a TAF event to offer help to our Members to navigate the plethora of new courses and qualifications. It is particularly important for our SME Members to have access to up to date information about training courses to guide them when recruiting for their business needs.”

Did you know?

‘Education Landscape: A Guide for Employers’ is adaptable and can be personalised for your own association – see below:

Download the Education Landscape: A Guide for Employers

- Editable Guide Cover (Download and insert your associations’ logo to be added to the guide)

- Editable Index Cover (Download and insert your associations’ logo to be added to the index)

- Case Study Template (Download and insert your own case study)

- Case Study Template Guidance (How to insert your own case study)

Loading...

Loading...

Jenifer Burden, Gatsby Director of Programmes explains, “Whether it’s careers fairs, industry placements for older students, apprenticeships, or shorter programmes to support upskilling for employees, the need for education, businesses and associations to collaborate has never been stronger. For a smaller business or association however, the breadth and variety of the opportunities can be hard to keep up with, especially for those without dedicated Human Resources or Learning and Development teams.

“This is why we are working with trusted business support organisations to provide small businesses and associations with a clear starting point. The Education Landscape guide explains how SMEs and smaller associations can get involved with education and skills and shares the benefits that small business owners have experienced.

“By being involved, business support organisations are working closely with SMEs, widening the career opportunities for young people and nurturing the critical role businesses and associations play in building and developing their skilled workforce.”

Find out more about how the Guide can benefit you at our TAF members webinar – “How Associations Can Meet The Future Skills Challenge“. Hear from associations who have already reaped the benefits of the Education Landscape, and find out how you can utilise these resources to meet the future skills challenge.

To join, register here

Date: 20/03/24

Time: 09:30-10:30

A trade association’s central mission is to help its members, so it is no surprise that associations have had to develop more sophisticated approaches to risk and resilience.

Managing risk should be a key part of your organisational strategy and it can be hard to know where to start, this collaborative report between TAF and our partners at Partners&, a leading insurance advisory business, explores how associations approach risk and resilience in their own operations, and the steps to take to protect your association from risk.

Read the full report here:

Loading...

Loading...

By Nathan Coyne, Managing Director at PoliMapper

Change is coming to Westminster.

You could argue that, with a general election just around the corner, it is only to be expected.

But what’s of particular interest with this general election is the scale of potential change.

This is due to the combination of circumstances that sees large numbers of MPs standing down, and the potential for sequential landslide victories by different parties.

At the time of writing, data from Polimapper’s Candidate Connect database showed that 77 MPs had announced their intention to stand down permanently at the next election.

A further 28 had been either displaced by the Boundary Commission’s redrawing of parliamentary constituencies, been de-selected by their local party or lost the national party whip at Westminster.

With 105 of 650 MPs already accounted for, we next need to look at what the polls are telling us.

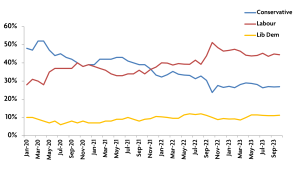

If reflected at the next general election, averages from 14 national polls in October 2023 show that Labour would secure a 15% swing from the Conservatives and a 13% swing from the SNP. The Liberal Democrats would secure a 10% swing from the Conservatives.

Should this transpire, the Conservatives’ landslide victory at the 2019 general election in England and the SNP’s in Scotland, would be entirely replaced by a Labour landslide victory in 2024.

This could lead to as many as 48% of MPs sitting in the House of Commons after the general election being new to the role.

To put this in context, only twice in the last 50 years has the number of new MPs exceeded one third – the landslide victory achieved by Tony Blair in 1997 (37%) and the advent of the coalition government in 2010 (33%).

Only once has the number of new MPs exceeded 50%; in 1945 when 324 of the then 640 MPs entered the House for the first time.

So what does this seismic level of change mean for associations and the organisations they represent?

To start with, you will need to prepare to invest in establishing relationships with the new cohort of MPs. Many of the networks you’ve carefully honed over several years will be holed below the water line and need to be replaced or renewed.

Such a large number of new MPs presents a policy challenge. What are their views? How many are broadly supportive of your interests? You’ll need to establish in which areas of policy such a large shake-up in personnel presents a threat, and in which it presents an opportunity.

But the good news is that you don’t need to wait until after the election to start this process – when incidentally you’d be competing with a whole host of other interests.

This is because a significant number of prospective parliamentary candidates have already been selected.

Polimapper’s Candidate Connect database shows that 275 prime candidates – defined as those succeeding an existing MP or standing in a key target seat – had already been selected (76% of the likely total).

Prime candidates are important because these are the candidates with the best chance of being elected and are thus worth an investment of time in getting to know.

There are many ways to do this, but we’ve picked out three that stand out.

Firstly, publish and send candidates your manifesto – ideally as succinctly packaged as possible in infographic or video form so they can digest your key messages.

Secondly, present them with information about your industry or profession through a constituency lens. Data on economic contribution, numbers of jobs, or simply just displaying information about member companies and facilities could help parliamentary candidates understand the value of your industry.

Thirdly, set up member site visits for parliamentary candidates. Allied with photo opportunities for the local press, site visits can be a win:win opportunity for associations and their members.

Unlike in 2017 and 2019, we have the benefit of time to prepare for a general election – it being anything from 5 to 11 months away.

With the level of change coming to Westminster, associations that use this time to invest in relationships with parliamentary candidates, are going to have a real advantage once the next parliament opens for business.

Nathan Coyne is the managing director of Polimapper.

Polimapper has published the first in-depth study into the characteristics of the 275-strong prime candidate pool, from which our new MPs will be drawn. Download the white paper at: http://www.polimapper.co.uk/class-of-24

Chart 1 – Voting intention since 2020

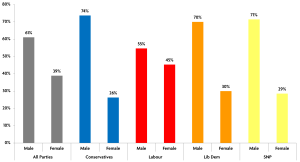

Chart 2 – gender split of prime candidates by party

By Lisa Jones, Corporate Partnerships Lead at Women on Boards

Recently I had the pleasure of partnering with TAF and hosted an event looking at Why Diversity Matters. We covered a lot of ground in the talk and I’m pleased to share the highlights with you:

The importance of a diverse workforce

Diverse teams perform better. We need teams of people with different views and lived experiences who ask difficult questions and challenge our biases. We need teams that reflect the society we sell to or serve. Why?

- Diversity confers expertise. Most of us are happy to listen to an IT expert regardless of their background.

- Diversity enables innovation – Different people hear and see different things. By bringing together a wide range of perspectives, you achieve new and better ideas.

- Diversity enables problem-solving – Watch the film The Imitation Game about Alan Turing. Diverse teams also change the way you think!

What issues surrounding diversity need to be addressed?

Diversity is not impactful without inclusion. Diverse teams are more complicated to manage, particularly for leaders not tuned in to working with different groups. They must understand individuals and their backgrounds and accept that people who are not like them think and work differently.

Good leaders are rare and have trained themselves to be collaborative because it is not easy. They have systems in place to ensure they make everyone feel involved.

Diverse groups need role models they want to follow. They need to feel represented and have access to opportunities to progress. If you can’t see it, you can’t be it.

What does the structure look like? How diverse is the leadership? What’s the organisation’s culture? There’s no magic fix, but it’s those at the most senior level who can create meaningful change.

How can we tackle these issues?

DO:

- Train your leaders on Inclusion

- Collect and understand your data: by division, department, country

- Train and support team leaders on collaboration

- Encourage disagreement

- Listen to and actively manage your minority networks

- Have an interview and promotion process that aligns with performance

DON’T:

- Focus on ‘fixing’ the minority, aka asking them to adapt to old styles of working

- Rely on minority leaders to lead the change

- Assume minority networks will fix the problem alone

- Assume that casual cross-mentoring will work

- Just put minorities on the interview panels

High-performing organisations work hard to be inclusive because they know it doesn’t happen by chance. It requires active effort.

There is still a long way to go!

Our 2022 report ‘Hidden Talent’ monitored the board diversity in the FTSE All-Share companies below the top 350.

- 50% of UK firms in FTSE All-Share ex350 have no women in C-Suite positions

- 44% of firms have not achieved the target of 33% women on boards

- A quarter of boards (25%) have one director of colour, up from 16% in 2021 – but 75% of boards are entirely white

Despite the challenges, progress is slowly being made and with continued effort, we can create more inclusive environments where everyone feels valued.

Lisa Jones is part of the Corporate Partnerships team at WB directors and would be happy to talk further with any TAF members to look at how WB Directors can support you when it comes to increasing the diversity of your organisations.

About Lisa:

Lisa Jones is in the Corporate Partnership Team at WB Directors, and recently spoke at a talk alongside other female leaders, looking at ‘Why Diversity Matters’. Lisa has spent her business life in marketing communications agencies, and secured her first board position in an agency, which was a significant moment in her career, as it allowed her to understand the key issues boards are faced with. At the time of her election to the board, diversity was not on the agenda, but she is delighted to have witnessed a major change in this area. Lisa is passionate about supporting others to reach their full potential in their careers, and enjoys sharing the practical approaches she’s learnt over the years.

WB Directors works with a wide range of organisations to inspire change and ensure that they support their talent with the most relevant programmes for their professional development.

Outside of WB Directors, Lisa is an active business angel investor and board Chair for the London based charity Regenerate, helping to transform deprived communities from the inside. Lisa is also a NED at The Feel Good Bakery and has been known to pick up her golf clubs occasionally – if only she had the time to improve her handicap!